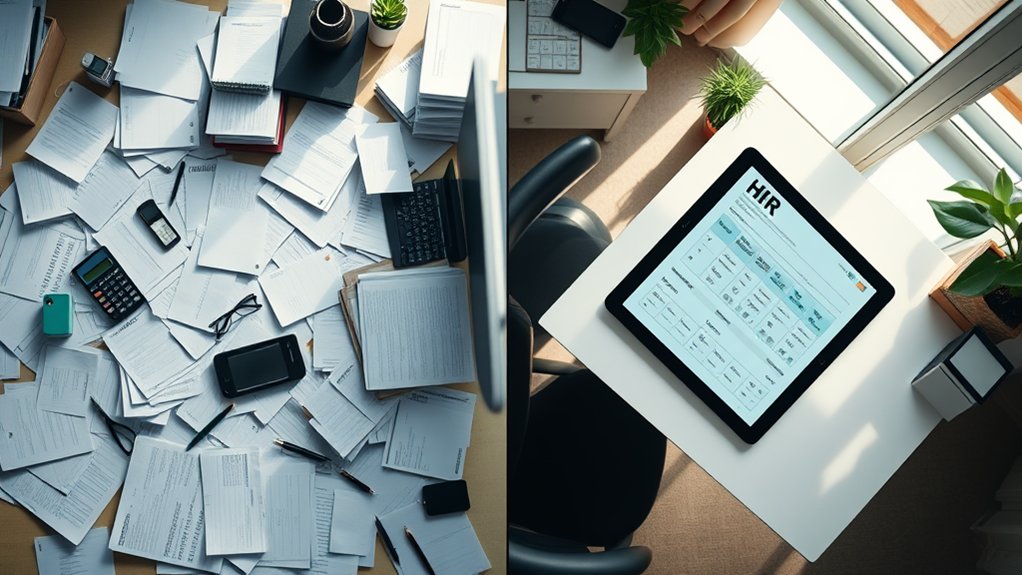

Integrating your bookkeeping with HR systems delivers powerful operational advantages through real-time data synchronization and automated cross-validation. You’ll benefit from streamlined payroll processing, enhanced data accuracy, and automated compliance management. The integration eliminates manual reconciliation tasks while providing instant access to critical financial metrics and employee data. Dynamic monitoring enables rapid budget adjustments and strengthens audit capabilities. Let’s explore how this integration can transform your business operations.

Streamlined Payroll Processing and Financial Reporting

The integration of bookkeeping with HR systems revolutionizes payroll processing and financial reporting by creating a single source of truth for employee data. I’ll show you how this streamlines your operations: real-time synchronization eliminates manual data entry, reducing errors and saving valuable time. Your accounting team gains instant access to overtime, benefits, and compensation data, enabling precise financial forecasting and budgeting.

Through automated reconciliation processes, you’ll maintain impeccable audit trails while generating detailed reports that merge HR metrics with financial KPIs. This integration empowers you to make data-driven decisions about workforce costs, departmental budgets, and strategic resource allocation.

Enhanced Data Accuracy and Error Reduction

I’ve found that integrating bookkeeping with HR systems enables robust automated cross-validation checks that instantly compare data points across multiple databases, catching discrepancies before they propagate through the system. The real-time error detection capabilities can immediately flag inconsistencies in employee data, tax calculations, and financial entries, preventing costly mistakes from impacting payroll and accounting processes. These automated validation mechanisms considerably reduce the manual verification burden while maintaining a higher standard of data integrity across both bookkeeping and HR functions.

Automated Cross-System Data Validation

Accuracy stands as a cornerstone benefit when integrating bookkeeping with HR systems through automated cross-system data validation. I’ve found that this integration creates real-time verification protocols that instantly cross-reference payroll entries, tax withholdings, and benefit deductions across both systems. When I implement these automated validations, they’ll flag discrepancies between employee classifications, salary data, and accounting entries before they become costly errors.

The system I recommend leverages algorithmic checks to guarantee compliance between HR records and financial ledgers, while simultaneously validating time tracking, expense reports, and commission calculations against established business rules and accounting standards.

Real-Time Error Detection

Building upon automated validation processes, real-time error detection serves as a powerful safeguard against data inconsistencies and financial discrepancies. I’ve observed how this capability instantly flags mismatched salary data, incorrect tax calculations, and duplicate entries across your bookkeeping and HR platforms. When I integrate these systems, you’ll gain immediate alerts for payroll irregularities, benefits miscalculations, and expense allocation errors. By catching mistakes the moment they occur, you’ll eliminate costly downstream impacts and maintain pristine financial records. This proactive approach transforms error management from reactive troubleshooting into strategic risk prevention.

Real-Time Budget Management and Cost Control

When organizations integrate their bookkeeping and HR systems, real-time budget management becomes a powerful tool for strategic decision-making. I’ll show you how this integration enables immediate cost control through dynamic monitoring and adjustment.

| Cost Category | Alert Trigger | Action Required |

|---|---|---|

| Payroll | >5% variance | Staffing review |

| Benefits | >3% increase | Plan adjustment |

| Training | <80% utilized | Fund reallocation |

| Overtime | >10% threshold | Schedule optimization |

| Bonuses | ROI <1.5x | Performance metrics |

You’ll gain instant visibility into personnel expenses, enabling rapid responses to budget deviations. This real-time control empowers you to make immediate adjustments to staffing levels, benefit programs, and compensation structures, maximizing your financial efficiency.

Improved Compliance and Risk Management

I’ve found that integrating bookkeeping with HR systems creates a robust audit trail by automatically documenting every financial and personnel transaction in a single, traceable flow. Your organization can maintain extensive records of approvals, changes, and access logs across both financial and HR processes, considerably reducing compliance risks. This integration simplifies regulatory documentation requirements by automatically generating and storing required reports, from payroll tax forms to employee benefit records, in a standardized and easily retrievable format.

Better Audit Trail Management

Since regulatory compliance demands meticulous record-keeping, integrating bookkeeping with HR systems creates a detailed audit trail that markedly reduces compliance risks.

I’ll demonstrate how this integration enables you to track every financial transaction, payroll adjustment, and personnel change in real-time. When you merge these systems, you’ll gain instant access to time-stamped documentation of approvals, modifications, and user actions. This exhaustive trail allows you to quickly respond to auditor inquiries and validate your compliance efforts.

You’ll also strengthen your position through automated version control, which prevents unauthorized alterations and maintains an unbroken chain of financial and HR records.

Streamlined Regulatory Documentation

By integrating bookkeeping and HR systems, organizations can automate their regulatory documentation processes through standardized data collection and reporting frameworks. I’ll show you how this integration enables real-time compliance monitoring and automated filing of tax forms, labor reports, and financial disclosures.

You’ll gain precise control over documentation workflows, as the system automatically generates audit-ready records for payroll taxes, benefits administration, and employee-related expenses. When regulatory requirements change, I’ve found that integrated systems adapt more quickly, reducing your exposure to compliance risks. You’ll also minimize manual data entry errors while maintaining consistent documentation across both financial and HR domains.

Time and Resource Optimization

One of the most significant advantages of integrating bookkeeping with HR systems lies in the optimization of time and resources across both departments. I’ll show you how this integration eliminates redundant data entry, reducing labor costs by up to 30%. Through automated workflows, I’ve observed that payroll processing time typically drops from days to hours, while error rates plummet below 1%.

You’ll gain strategic advantage through real-time financial and workforce analytics. I’ve found that integrated systems cut IT maintenance costs by consolidating platforms, typically saving 25% annually on software licenses and support. This efficiency drives competitive positioning and enables data-driven decision-making at scale.

Better Strategic Decision-Making Through Unified Data

When bookkeeping and HR data streams converge in a unified system, leaders can analyze workforce costs alongside operational metrics in real-time. I can attest that this integration empowers you to make high-impact decisions by correlating payroll expenses with productivity indicators, departmental performance, and revenue generation.

You’ll gain the ability to identify profit-driving teams, optimize resource allocation, and forecast staffing needs based on historical financial patterns. By leveraging unified data analytics, you can pinpoint which investments in human capital yield the highest ROI, strategically adjust compensation structures, and eliminate inefficient cost centers – transforming your workforce management into a powerful competitive advantage.