To handle bookkeeping for high client acquisition costs, I’ll help you set up dedicated general ledger accounts for each acquisition channel, including advertising, sales compensation, marketing technology, and lead generation expenses. You’ll need to implement precise tracking systems that connect your CRM with accounting software to monitor Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) metrics. By establishing proper expense allocation methods and cash flow management strategies, you’ll gain actionable insights to optimize your ROI across all acquisition activities.

Understanding and Categorizing Client Acquisition Costs

While many businesses focus primarily on direct expenses, client acquisition costs represent a crucial category that demands careful tracking and analysis in your bookkeeping system. I recommend categorizing these costs into distinct segments: advertising spend, sales team compensation, marketing technology subscriptions, and lead generation investments.

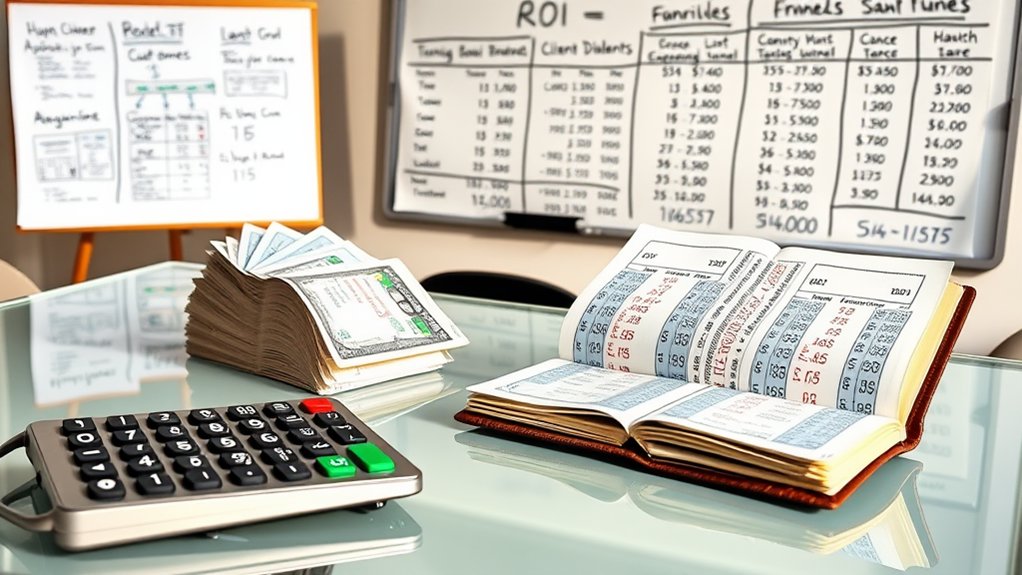

To maximize your financial control, establish separate general ledger accounts for each acquisition channel. Track both your Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) metrics. This granular approach enables you to assess ROI effectively and make data-driven decisions about resource allocation across different acquisition strategies.

Setting Up an Effective Chart of Accounts for CAC Tracking

I’ll guide you through creating a chart of accounts that effectively tracks your client acquisition costs across three essential categories: direct marketing expenses, sales team compensation, and campaign-specific overhead. You’ll need to establish clear methods for allocating shared acquisition costs, such as office space or administrative support, using data-driven attribution models. Monthly CAC reconciliation requires systematic review of these accounts, cross-referencing acquisition metrics with your accounting records to guarantee accurate cost-per-client calculations.

Account Categories for CAC

A well-structured chart of accounts serves as the foundation for tracking Client Acquisition Costs (CAC) effectively. I recommend organizing your CAC accounts into five primary categories: Marketing Expenses, Sales Personnel Costs, Technology & Software, Commission & Referral Fees, and Overhead Allocation.

I’ll help you break these down further into subcategories. Under Marketing, track digital advertising, content creation, and event costs. Sales Personnel should include salaries, benefits, and training. Technology encompasses CRM systems and sales tools. Commission accounts separate internal and external payments. Finally, allocate overhead costs like office space and utilities based on your sales team’s percentage of total operations.

Allocating Acquisition Overhead Costs

Properly allocating overhead costs to client acquisition activities requires a systematic approach and detailed tracking system. I recommend establishing clear cost pools for specific acquisition channels and mapping indirect expenses proportionally across them.

I track staff time dedicated to sales activities, marketing technology subscriptions, office space used for client acquisition, and shared administrative support. Then I calculate allocation percentages based on direct labor hours or revenue generation per channel.

My proven method involves creating separate ledger accounts for each overhead category and using activity-based costing to distribute expenses accurately. This granular approach gives me precise CAC metrics for strategic decision-making.

Monthly CAC Reconciliation Process

Setting up an effective chart of accounts forms the foundation for accurate monthly CAC reconciliation. I’ve developed a structured approach that separates acquisition costs into distinct categories, enabling precise tracking and analysis.

| Account Category | Purpose |

|---|---|

| Direct CAC | Sales commissions, advertising |

| Indirect CAC | Marketing overhead, tools |

| Allocation Pool | Shared resources, admin costs |

I allocate these costs monthly using my reconciliation checklist: verify all expenses are properly coded, calculate per-client acquisition metrics, and adjust allocation percentages based on actual resource utilization. This system lets me maintain granular cost control while providing actionable insights for strategic decision-making.

Implementing Systems to Monitor Customer Lifetime Value

Monitoring customer lifetime value effectively requires implementing robust tracking systems that capture both revenue data and behavioral metrics. I recommend integrating your CRM with your accounting software to track individual customer transactions, service upgrades, and retention periods. You’ll need to establish unique customer IDs that connect all revenue streams to specific clients.

Configure your system to automatically calculate key metrics: average purchase value, purchase frequency, and customer lifespan. I’ve found that breaking down CLV by acquisition channel provides essential insights for optimizing marketing spend. Link these metrics to your CAC calculations to determine true ROI per customer segment.

Best Practices for Expense Allocation and Attribution

To effectively manage high client acquisition costs, businesses must implement granular expense allocation systems that accurately attribute costs to specific customer segments and revenue streams. I recommend adopting a multi-tier attribution model that tracks both direct and indirect acquisition expenses. You’ll need to set up cost centers for marketing channels, sales activities, and customer onboarding processes.

I’ve found that implementing activity-based costing (ABC) provides the most precise allocation of overhead expenses. This approach lets you identify which acquisition strategies deliver the highest ROI. When you combine ABC with cohort analysis, you’ll gain actionable insights into your most profitable customer segments.

Managing Cash Flow With High Acquisition Investments

I recommend implementing detailed tracking systems to monitor your client acquisition costs against revenue streams, allowing you to measure ROI for each marketing channel and campaign. You’ll need to carefully analyze the timing gap between your upfront acquisition investments and the eventual income those clients generate, which directly impacts your cash flow planning. I suggest maintaining separate ledgers for acquisition spending versus operational expenses, enabling you to make strategic decisions about scaling your client acquisition efforts while preserving adequate operating capital.

Track Client Acquisition Spending

Proper tracking of client acquisition costs demands meticulous documentation of every dollar spent on marketing, sales, and onboarding activities. I recommend implementing a dedicated cost-tracking system that separates direct acquisition expenses from general overhead.

I categorize expenses into specific channels: digital advertising, content creation, sales team commissions, and client onboarding resources. By assigning unique tracking codes to each campaign and initiative, I can calculate precise ROI metrics for every acquisition strategy.

This granular approach enables me to identify which channels deliver the highest-value clients and optimize my spending accordingly, maximizing the impact of my acquisition investments.

Balance Income Vs Investment

While client acquisition investments are essential for growth, balancing these upfront costs against incoming revenue requires sophisticated cash flow management. I’ve found that tracking your client lifetime value (CLV) against customer acquisition cost (CAC) is vital. Maintain a minimum 3:1 CLV-to-CAC ratio to guarantee profitability.

I recommend establishing a dedicated acquisition budget that’s directly tied to your revenue forecasts. Calculate your cash runway, factoring in delayed ROI from acquisition spending. Set strict spending thresholds and monitor key performance indicators weekly. If acquisition costs exceed 40% of your projected annual revenue, I advise reassessing your growth strategy.

Creating Reports to Measure ROI and Profitability

Financial reports are essential tools for businesses with high client acquisition costs to track return on investment and measure profitability across different customer segments. I recommend creating three key reports: a Customer Acquisition Cost (CAC) analysis that breaks down spending per client, a Customer Lifetime Value (CLV) calculation that projects long-term revenue, and a cohort analysis that segments clients by acquisition period.

I integrate these reports with my cash flow statements and P&L to monitor the relationship between acquisition spending and revenue generation. This enables me to optimize my marketing budget and identify which customer segments deliver the highest ROI.