Tracking employee training costs through proper bookkeeping delivers multiple strategic advantages for your business. You’ll maximize tax deductions by documenting all training-related expenses, optimize budget allocation through data-driven decisions, and demonstrate clear ROI on development programs. Careful record-keeping also guarantees compliance with regulatory requirements while providing detailed analytics for future training investments. Understanding these key benefits will help you transform your training program into a measurable driver of business success.

Maximizing Tax Deductions Through Accurate Training Expense Records

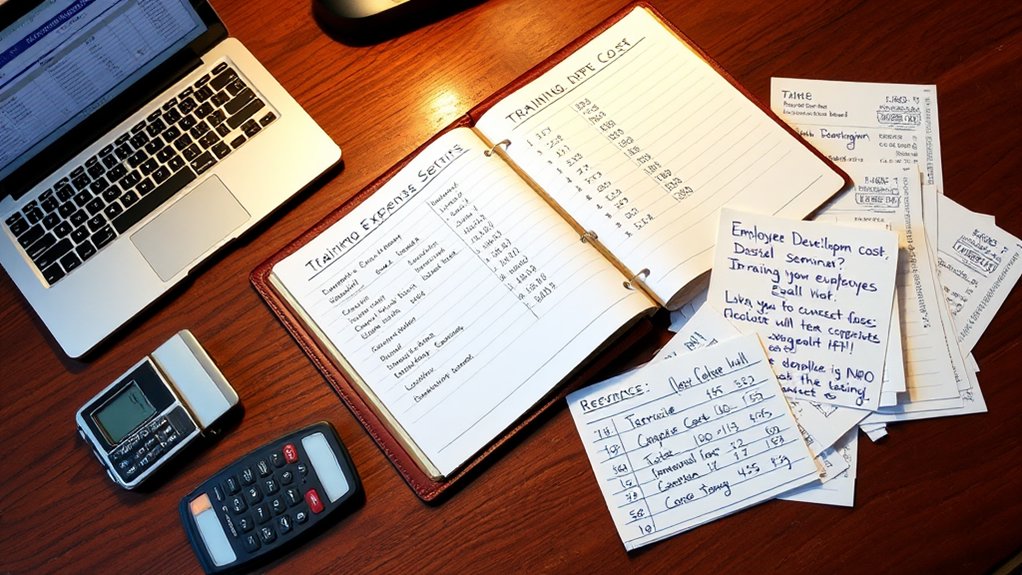

Many businesses overlook the significant tax advantages available through proper documentation of employee training expenses. I’ll show you how to maximize your deductions through meticulous record-keeping. Track every training-related cost – from registration fees and materials to travel expenses and instructor compensation. You’ll need to maintain detailed logs of dates, participants, purpose, and associated costs. I recommend creating separate ledger accounts for different training categories to simplify tax preparation. By implementing a systematic approach to expense tracking, you’ll guarantee full compliance while optimizing your tax position. Remember to retain all supporting documentation for potential audits.

Better Budget Planning and Resource Allocation

While tracking training expenses provides tax benefits, the data also serves as a critical foundation for strategic budget planning. I’ll show you how proper bookkeeping empowers you to allocate resources with precision and control.

| Budget Component | Strategic Impact |

|---|---|

| Historical Data | Enables trend analysis and forecasting |

| Cost Per Employee | Determines ROI and scaling decisions |

| Department Allocation | Optimizes resource distribution |

| Program Effectiveness | Guides investment priorities |

| Vendor Costs | Leverages negotiation power |

With this data-driven approach, you’ll make informed decisions about training investments, eliminate wasteful spending, and strategically deploy resources where they generate maximum returns. Your ability to plan budgets becomes a competitive advantage.

Demonstrating ROI on Employee Development Programs

Beyond tracking costs alone, demonstrating return on investment for employee development programs requires systematic measurement and analysis of both financial and non-financial outcomes. I measure ROI by calculating productivity gains, reduced turnover costs, and increased revenue per employee against total training expenditures. I quantify improvements in employee performance metrics, client satisfaction scores, and operational efficiency indicators. By maintaining detailed records of training investments and corresponding business impacts, I establish clear correlations between development initiatives and organizational success. This data-driven approach enables me to justify training budgets and secure continued investment in employee development programs.

Ensuring Compliance With Training Requirements

The systematic tracking of employee training isn’t complete without proper compliance monitoring. I’ve found that maintaining detailed records helps you demonstrate adherence to regulatory requirements and industry standards while protecting your organization from potential liability.

Key compliance benefits of tracking training through bookkeeping:

- Provides auditable documentation for certification renewals and mandatory training completion

- Enables quick responses to regulatory audits with centralized, accurate records

- Creates accountability through timestamped verification of training milestones

Data-Driven Decision Making for Future Training Investments

I track return on investment (ROI) metrics for each training program over multiple quarters to identify which initiatives deliver the most value for our organization. By calculating the training cost per employee and comparing it against performance improvements, I can make data-backed recommendations for future training investments. These analytics help me pinpoint which programs deserve increased funding and which should be modified or discontinued to optimize our training budget.

ROI Analysis Over Time

Measuring return on investment (ROI) for employee training programs requires systematic analysis across multiple time horizons to validate their effectiveness and guide future spending decisions. I track ROI metrics quarterly to identify trends and optimize our training budget allocations.

Key performance indicators I monitor include:

- Revenue generated per trained employee versus untrained peers

- Reduction in operational errors and associated costs

- Employee retention rates among training program participants

Training Cost Per Employee

How effectively we track per-employee training expenses shapes our ability to make data-driven investment decisions. I calculate individual training costs by dividing total program expenses by participant count, then breaking down specific components like materials, instructor fees, and facility costs per person.

I’ve found that isolating these granular metrics reveals critical insights about scaling efficiency. When I analyze cost variations between departments and training types, I can identify which investments yield best, ideal, or most favorable returns. This precision enables me to allocate resources strategically, negotiate better vendor rates, and defend my training budget with hard data that demonstrates clear cost-benefit ratios.

Cost Analysis and Program Efficiency Evaluation

I’ll help you evaluate your training program’s efficiency by measuring three critical metrics: ROI trends across multiple training cycles, variances between budgeted and actual costs, and per-employee training expenses. Your ROI tracking should include both quantitative measures like productivity gains and qualitative improvements in employee performance. By analyzing these metrics together, you’ll identify which training investments deliver the highest value while spotting opportunities to optimize your program’s cost structure.

ROI Measurement Over Time

The systematic tracking of ROI across multiple training cycles reveals indispensable patterns in your program’s financial performance and effectiveness. I’ve found that longitudinal ROI analysis enables you to make data-driven decisions about resource allocation and program optimization.

To maximize the power of ROI tracking over time, focus on these essential metrics:

- Cost per employee competency gain

- Revenue generated from improved performance

- Reduction in operational errors and associated costs

Budget Vs Actual Spending

When comparing budgeted versus actual training costs, systematic variance analysis becomes essential for evaluating program efficiency and controlling expenditures. I track these variances through detailed line-item analysis, enabling me to identify cost overruns and opportunities for optimization.

| Cost Category | Variance Analysis |

|---|---|

| Materials | Compare unit costs |

| Facilities | Track usage rates |

| Instructors | Monitor hourly rates |

| Technology | Assess ROI metrics |

| Administration | Review overhead % |

I’ve found that this structured approach reveals critical insights into spending patterns, helping me make data-driven decisions about resource allocation and program adjustments to maximize training effectiveness while maintaining fiscal discipline.

Training Cost Per Employee

Building on our variance analysis insights, calculating precise per-employee training costs provides a foundational metric for evaluating program efficiency. I calculate this by dividing total training expenditure by the number of participating employees, revealing the investment per individual.

This granular cost breakdown enables you to:

- Benchmark against industry standards to assess competitiveness

- Identify high-value training initiatives versus underperforming ones

- Scale programs strategically based on ROI metrics