Single-entry and double-entry bookkeeping differ fundamentally in their recording methods and intricacy. I’ll explain: Single-entry bookkeeping records each transaction once as either income or expense, making it suitable for small businesses with simple finances. Double-entry bookkeeping records each transaction twice using debits and credits that must balance, providing better accuracy and financial control. While single-entry offers basic cash flow tracking, double-entry’s extensive system enables thorough financial analysis and strategic decision-making. Understanding these distinctions will help determine which method best serves your business needs.

Understanding Single-Entry Bookkeeping: A Basic Approach

Single-entry bookkeeping boils down to a straightforward method of recording financial transactions in which each entry affects only one account. I’ll show you how this basic system works by tracking either incoming or outgoing funds in a single ledger, similar to maintaining a personal checkbook.

You’ll find this method most useful for small businesses and sole proprietorships where transactions remain relatively simple. While it doesn’t provide the robust financial controls of double-entry systems, it offers quick implementation and ease of use. I recommend it when you’re managing basic income statements, expense tracking, or monitoring your business’s cash flow.

The Mechanics of Double-Entry Bookkeeping Systems

I’ll explain how double-entry bookkeeping operates through its foundational principle that every financial transaction must have equal and opposite entries – debits must always equal credits. Within this system, I record each transaction as a pair of journal entries, where one account receives a debit while another receives a corresponding credit. These paired entries then follow strict posting rules as they flow into the general ledger, where accounts maintain their natural debit or credit balances according to the accounting equation.

Balancing Debits and Credits

When implementing a double-entry bookkeeping system, one must understand the fundamental principle that every financial transaction affects at least two accounts simultaneously, with equal debits and credits. I’ll show you how debits and credits must always balance in this powerful accounting equation.

| Account Type | Normal Balance |

|---|---|

| Assets | Debit |

| Liabilities | Credit |

| Revenue | Credit |

| Expenses | Debit |

| Equity | Credit |

To maintain control over your financial records, remember that total debits must equal total credits in every transaction. I’ll emphasize that mastering this balance gives you precise oversight of your business’s financial position and empowers strategic decision-making.

Recording Journal Entry Pairs

Double-entry bookkeeping comes down to systematically recording each transaction with paired journal entries that affect two or more accounts. When I record these pairs, I’m following the fundamental accounting equation: Assets = Liabilities + Owner’s Equity.

I record a debit entry in at least one account and a credit entry in at least one other account, ensuring they equal each other. For example, if I purchase $5,000 in inventory with cash, I debit Inventory (+$5,000) and credit Cash (-$5,000). This balanced approach creates a verifiable audit trail and helps me detect errors quickly.

Account Ledger Posting Rules

These paired journal entries must follow specific posting rules when moving from the journal to individual account ledgers. I post debit entries to the left side of T-accounts and credit entries to the right side. When I transfer amounts from the journal to asset accounts, I increase them with debits and decrease them with credits. For liability and equity accounts, I do the opposite – increasing with credits and decreasing with debits. I maintain this mathematical balance for every transaction, ensuring the total debits always equal total credits across all affected accounts.

Key Features That Set These Methods Apart

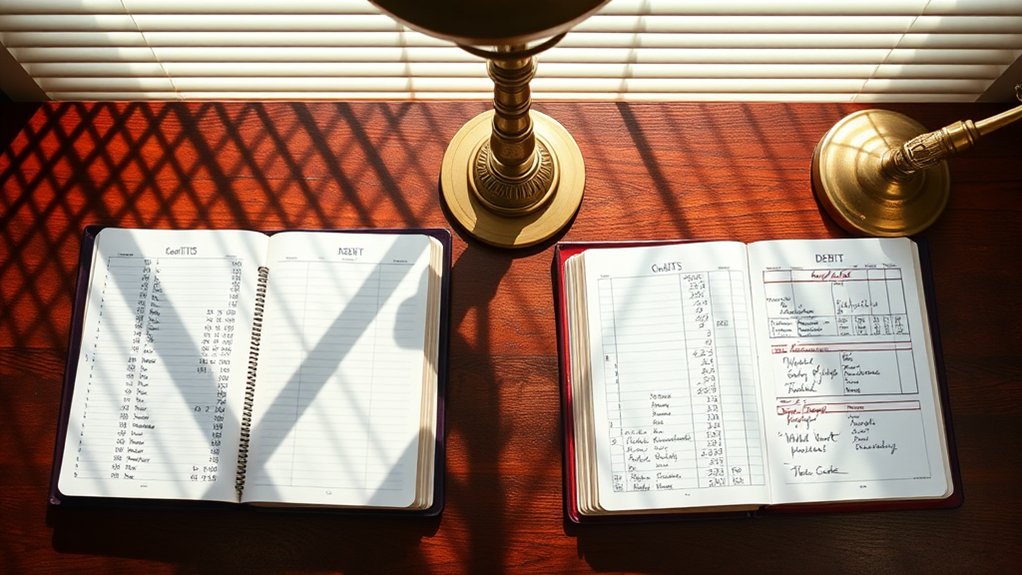

I’ll guide you through the fundamental features that distinguish single-entry from double-entry bookkeeping systems, focusing on their distinct approaches to recording financial data. While single-entry bookkeeping tracks basic income and expenses in a straightforward ledger, double-entry methods require each transaction to have equal and opposite entries across different accounts. The double-entry system’s built-in error detection capabilities, through balanced debits and credits, provide vastly more accuracy in tracking financial transactions compared to the simpler verification methods of single-entry systems.

Recording Methods and Processes

The two accounting methods differ fundamentally in their recording processes. In single-entry bookkeeping, I record each transaction once as either income or expense in a cash book or journal. I’ll note payments, receipts, and running balances in a straightforward manner.

With double-entry bookkeeping, I must record each transaction twice – as both a debit and credit – maintaining the accounting equation’s balance. When I receive payment, I’ll debit cash and credit revenue accounts simultaneously. This dual-aspect recording creates a self-checking system that gives me greater control and accuracy in tracking my business’s financial position.

Track Financial Transactions

Each accounting method tracks financial transactions distinctly, with key differences in thoroughness and intricacy.

In single-entry bookkeeping, I’ll record each transaction once, similar to maintaining a personal checkbook. I enter income and expenses in a basic journal, tracking only the changes in cash accounts.

In double-entry bookkeeping, I must record every transaction twice – as both a debit and credit. I’ll document how each entry affects at least two accounts, capturing the complete financial impact. This system enables me to track assets, liabilities, equity, revenues, and expenses with precision, providing an extensive view of my business’s financial position.

Error Detection Systems

Built-in error detection capabilities represent a crucial difference between these bookkeeping methods. Double-entry bookkeeping offers superior error detection through its self-balancing system, where total debits must equal total credits. I’ll spot errors quickly when my balance sheet doesn’t reconcile.

Single-entry lacks this built-in verification mechanism. When I make a mistake in single-entry, I might not discover it until much later, if at all. The double-entry system’s trial balance reveals mathematical errors, transposition mistakes, and missing entries immediately. This systematic error detection gives me greater control and confidence in my financial data’s accuracy.

Advantages and Limitations of Each System

Understanding both systems’ strengths and weaknesses helps businesses make informed decisions about their accounting methods. Let me break down the key advantages and limitations of single-entry and double-entry bookkeeping.

| Aspect | Single-Entry | Double-Entry |

|---|---|---|

| Complexity | Simple to maintain | More complex system |

| Error Detection | Limited verification | Built-in error checks |

| Business Size | Suited for small operations | Essential for larger enterprises |

| Cost | Lower implementation cost | Higher investment required |

| Financial Insight | Basic financial overview | Inclusive financial analysis |

I’ve found that while single-entry works well for sole proprietors and small businesses, double-entry’s robust framework offers superior financial control and accuracy for growing organizations. The choice ultimately depends on your business scale, complexity, and reporting needs.

Choosing the Right Method for Your Business

With the advantages and limitations clearly laid out, selecting the most suitable bookkeeping method requires a methodical assessment of your business characteristics.

I recommend single-entry bookkeeping if you’re running a small, service-based business with simple transactions and no inventory. It’s ideal if you’re a sole proprietor or independent contractor handling fewer than 100 monthly transactions.

Choose double-entry bookkeeping if you’re managing inventory, have multiple employees, or need detailed financial insights. I advise this system when you’re seeking investment capital, planning expansion, or dealing with complex tax situations. It’s essential for corporations and businesses with annual revenues exceeding $5 million.

Best Practices for Implementation and Maintenance

Successful implementation of either bookkeeping method boils down to establishing clear protocols from day one. I recommend documenting your chart of accounts, setting consistent entry schedules, and maintaining meticulous records of all financial transactions.

To ensure long-term success, I’ve found that regular reconciliation is vital. You’ll want to verify your books against bank statements monthly, implement robust backup systems, and establish internal controls to prevent errors. I advise conducting periodic audits and staying current with accounting software updates. Remember, whichever method you choose, consistency in your approach will drive accuracy and compliance with accounting standards.