To prepare for tax season as a small business owner, I recommend establishing a systematic approach to financial record-keeping throughout the year. You’ll need to organize receipts, track expenses, and maintain detailed documentation of all business transactions. I suggest leveraging digital tools for scanning and categorizing documents while understanding available deductions and credits for your business structure. Working with a qualified tax professional and implementing year-round planning strategies will help maximize your tax benefits and minimize stress.

Organize Your Financial Records and Documentation

As a small business owner, organizing your financial records and documentation is the critical first step in preparing for tax season. I recommend creating a systematic filing structure for your receipts, invoices, bank statements, and expense records. Establish separate folders for revenue streams, operational costs, payroll documents, and asset purchases.

Leverage digital tools to scan and categorize paper documents, ensuring backup copies exist. Track your vehicle mileage, business travel expenses, and home office costs meticulously. Maintain detailed records of client payments, vendor transactions, and inventory data. This organization will streamline your tax preparation and maximize potential deductions.

Understanding Small Business Tax Deductions and Credits

Small business owners can greatly reduce their tax burden by understanding and properly claiming available deductions and credits. I’ll help you maximize your tax savings through strategic deductions that the IRS allows for legitimate business expenses.

Key deductible areas you must track include:

- Home office expenses, including utilities, insurance, and repairs

- Vehicle expenses, mileage, and business-related travel costs

- Equipment purchases, supplies, and professional development

Don’t overlook tax credits for hiring employees, implementing energy-efficient improvements, or providing healthcare coverage. These credits directly reduce your tax liability dollar-for-dollar, making them even more valuable than deductions.

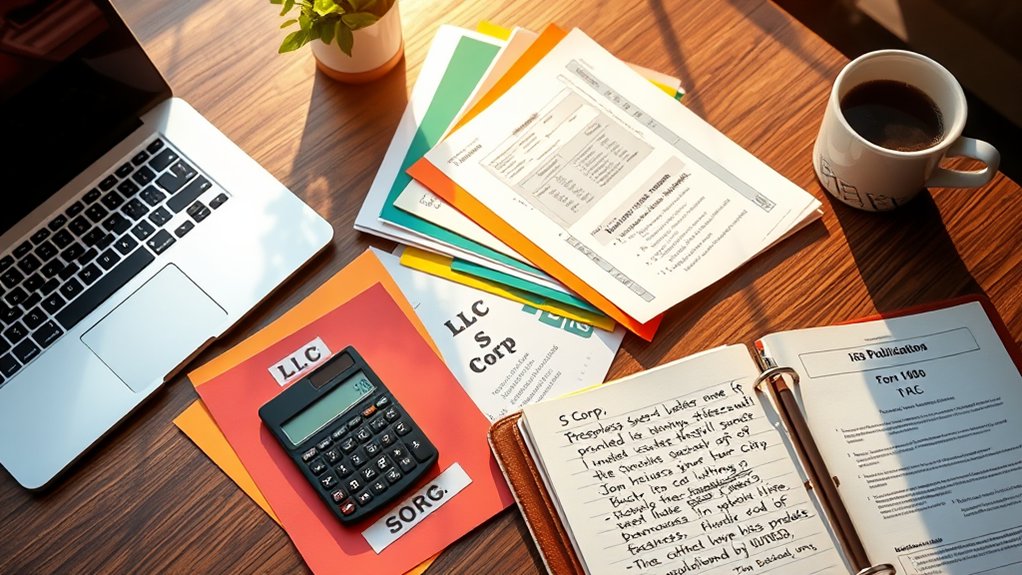

Choosing the Right Filing Status and Business Structure

Selecting the right business structure and filing status represents one of the most pivotal decisions you’ll make as a business owner, since it impacts everything from your tax obligations to personal liability protection. I’ll help you navigate these critical choices to maximize your tax advantages and protect your assets.

| Structure | Key Tax Implications |

|---|---|

| Sole Prop | Direct personal tax |

| LLC | Flow-through option |

| S-Corp | Salary/distribution split |

| C-Corp | Double taxation risk |

| Partnership | Shared tax burden |

Working With Tax Professionals and Software Tools

The complexity of business tax preparation often necessitates professional expertise and reliable software solutions. I recommend evaluating your needs and choosing between a Certified Public Accountant (CPA), Enrolled Agent (EA), or tax software based on your business’s scope and complexity.

When selecting professional support, prioritize these critical factors:

- Industry-specific expertise and experience with businesses similar to yours

- Tech integration capabilities with your existing accounting systems

- Year-round availability for strategic tax planning, not just filing season

I’ve found that combining professional guidance with robust software tools creates an all-encompassing tax management system that maximizes deductions while ensuring compliance.

Year-Round Tax Planning Strategies

Building on professional tax support, successful tax management requires a proactive, year-round approach rather than a last-minute scramble. I recommend implementing quarterly financial reviews to track your business performance and tax obligations. Start by establishing a dedicated tax savings account and maintaining meticulous expense records through digital tools.

Consider strategic timing for major purchases and revenue recognition to optimize your tax position. I’ve found that regular consultations with your tax advisor help identify opportunities for deductions and credits while ensuring compliance. Make estimated tax payments on schedule to avoid penalties, and stay informed about changing tax laws that could impact your business strategy.