Key bookkeeping terms for asset management include fixed assets (PP&E), current assets, depreciation methods, and valuation principles. I’ll note that you’ll encounter concepts like straight-line depreciation, declining balance, and amortization when tracking long-term assets. Working capital components involve cash, receivables, and inventory, while disposal procedures require documenting fair market values and gains/losses. Understanding these foundational terms opens the door to mastering asset lifecycle accounting.

Fixed Assets and Long-Term Asset Classification

When managing a company’s resources, fixed assets and long-term assets represent significant capital investments that remain on the balance sheet for multiple reporting periods. I classify these assets based on their expected useful life, which typically exceeds one year. Fixed assets include property, plant, and equipment (PP&E), while long-term assets encompass intangibles like patents and goodwill.

I leverage depreciation methods to allocate the cost of these assets systematically. Each asset category requires specific treatment: straight-line depreciation for buildings, declining balance for machinery, and amortization for intangible assets. This strategic classification guarantees ideal tax advantages and precise financial reporting.

Understanding Depreciation Methods and Calculations

As businesses acquire fixed assets, understanding depreciation methods becomes essential for accurate financial reporting and tax compliance. I’ll share the most valuable methods you’ll need to master for strategic asset management.

| Method | Calculation Pattern | Best Use Case |

|---|---|---|

| Straight-Line | Equal annual amounts | Buildings, furniture |

| Double Declining | Accelerated early years | Technology, vehicles |

| Sum-of-Years | Decreasing amounts | Heavy machinery |

| Units of Production | Based on actual usage | Manufacturing equipment |

You’ll want to select the method that maximizes tax advantages while accurately reflecting your asset’s true economic decline. Each approach impacts your financial statements differently, affecting your bottom line and stakeholder perceptions.

Current Assets and Working Capital Management

Managing current assets effectively requires a deep understanding of working capital components and their cyclical nature. I’ll show you how to maximize your cash conversion cycle while maintaining ideal liquidity levels. Working capital management directly impacts your company’s operational efficiency and profitability potential.

- Cash and cash equivalents provide immediate operational liquidity

- Accounts receivable represents future incoming cash flows

- Inventory management affects storage costs and capital tied up

- Short-term investments balance liquidity with yield

- Working capital ratio measures operational financial health

Your ability to control these elements determines your competitive advantage. By monitoring key ratios and maintaining appropriate levels of current assets, you’ll strengthen your company’s financial position and enhance stakeholder value.

Asset Valuation Principles and Methods

The accurate valuation of assets forms the cornerstone of effective financial reporting and decision-making. I’ll show you how to master the core valuation methods: historical cost, fair market value, and replacement cost. Your assets’ book value must reflect depreciation and potential impairment losses to maintain accuracy.

I emphasize using mark-to-market accounting when dealing with financial instruments and implementing the lower of cost or market (LCM) principle for inventory. You’ll gain control through strategic revaluation of fixed assets, ensuring your balance sheet remains robust. Remember, proper asset valuation directly impacts your equity position and borrowing power.

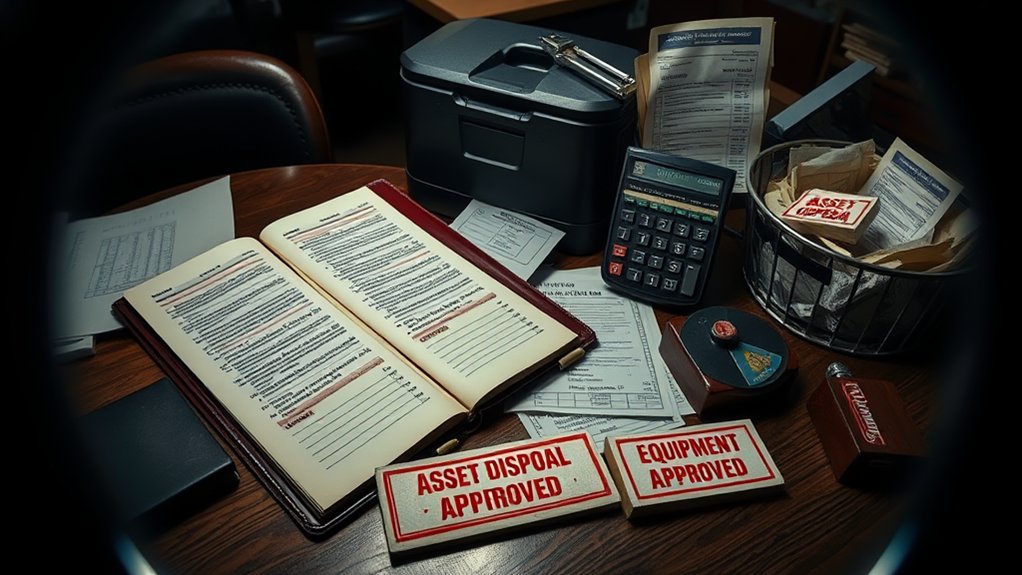

Asset Disposal and Write-Off Procedures

When organizations dispose of or write off assets, proper accounting procedures must be followed to maintain accurate financial records. I’ll show you how to execute these critical procedures to maintain control over your asset management and ascertain compliance with accounting standards.

- Record the asset’s fair market value at disposal date

- Calculate and document any gains or losses from the disposal

- Remove the asset and accumulated depreciation from books

- Process write-offs for damaged or obsolete assets through loss accounts

- Update subsidiary ledgers and financial statements accordingly

Through these procedures, I’ll help you maintain precise control over your asset lifecycle management while maximizing tax advantages and financial reporting accuracy. Let’s master these essential bookkeeping practices together.