To guarantee payroll compliance, I recommend a five-part strategy: master federal and state wage laws, properly classify employees as exempt or non-exempt, maintain detailed records for 4+ years, stay current with tax obligations, and implement regular internal audits. You’ll need accurate time tracking, proper tax withholdings, and systematic documentation of all payroll decisions. A methodical approach to these core requirements will protect your business from costly compliance issues – this exhaustive system runs deeper than you might expect.

Understanding Key Payroll Laws and Requirements

When managing payroll operations, employers must comply with a complex framework of federal, state, and local regulations that govern how businesses pay their employees. I’ll help you navigate the essential laws you need to know.

You must understand FLSA requirements for minimum wage, overtime calculations, and exempt vs. non-exempt classifications. You’re also responsible for following federal tax withholding rules, state-specific wage requirements, and local tax obligations. Pay close attention to worker classification laws, equal pay regulations, and mandatory benefits requirements.

I recommend creating a compliance checklist that incorporates all applicable regulations for your jurisdiction and industry.

Establishing Accurate Employee Classification Systems

Building on our understanding of payroll laws, proper employee classification forms the backbone of compliant payroll operations. I’ll help you establish an accurate system that protects your business from costly misclassification penalties and legal challenges.

- Start by determining whether each worker qualifies as an employee or independent contractor using the IRS control tests for behavioral, financial, and relationship factors

- Classify employees correctly as exempt or non-exempt based on FLSA salary thresholds and duties tests

- Document your classification decisions with detailed job descriptions, contracts, and regular audits to maintain defensible positions

You’ll need to review these classifications annually as roles evolve.

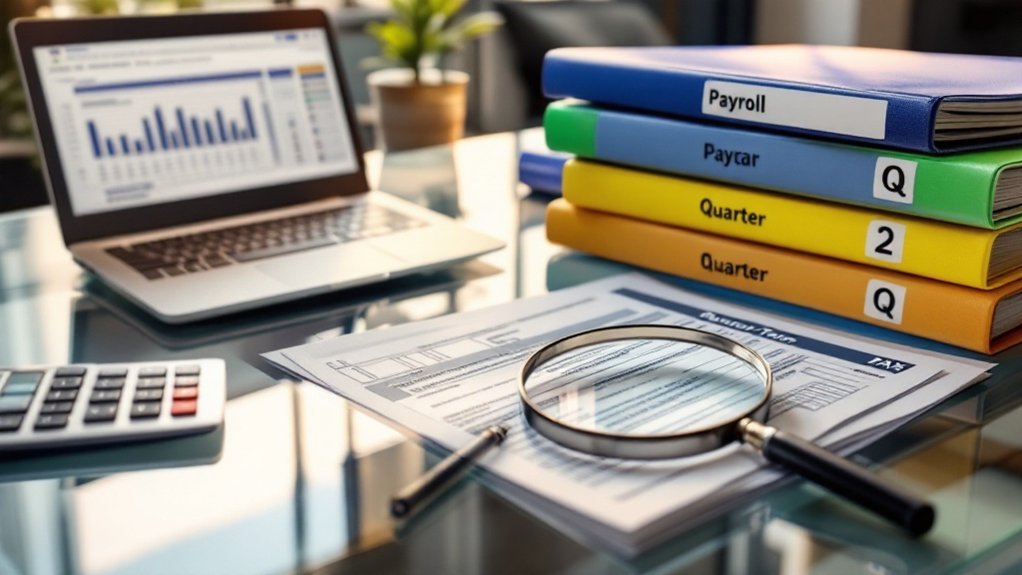

Implementing Proper Record-Keeping Practices

Accurate record-keeping serves as the foundation for payroll compliance and audit readiness. I recommend implementing a robust system that tracks essential data: hours worked, wages paid, overtime calculations, tax withholdings, and benefits deductions. I maintain digital and physical copies of all payroll records for at least four years, as required by federal law.

I guarantee my record-keeping system includes detailed documentation of wage rates, pay periods, and employment dates. I verify that time cards, wage statements, and tax forms are properly stored and easily accessible. This systematic approach safeguards my business during audits and supports precise payroll execution.

Maintaining Tax Compliance and Reporting

Staying on top of tax compliance demands meticulous attention to federal, state, and local requirements. I’ve found that maintaining strict adherence to tax regulations protects your business from costly penalties and audits. You’ll need to establish a systematic approach to meet all filing deadlines and reporting obligations.

- File all required tax forms on time, including W-2s, 1099s, and quarterly employment tax returns

- Calculate and remit payroll taxes accurately, including Social Security, Medicare, and unemployment taxes

- Monitor changes in tax rates and thresholds across jurisdictions, updating your systems immediately when changes occur

I recommend documenting every tax-related decision and maintaining detailed support records.

Developing Internal Payroll Audit Procedures

While maintaining tax compliance focuses on external requirements, internal audit procedures serve as your first line of defense against payroll errors and fraud. I recommend implementing these key audit components to maintain control of your payroll process:

| Audit Area | Key Actions |

|---|---|

| Data Entry | Verify employee information, rates, deductions |

| Calculations | Test gross-to-net computations, tax withholdings |

| Disbursements | Review payment accuracy, authorize transactions |

| Documentation | Maintain audit trails, verify supporting records |

I conduct monthly spot checks of these areas and immediately investigate any discrepancies. This proactive approach helps you catch issues before they become costly problems and demonstrates your commitment to payroll integrity.