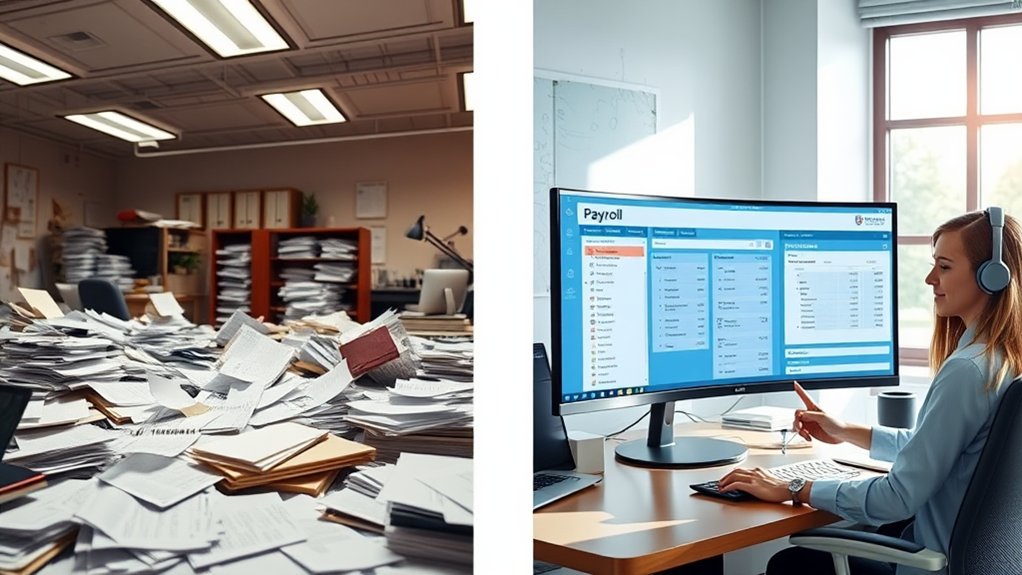

Managing employee benefits through payroll streamlines administrative processes while maximizing tax advantages and compliance. I’ve found this approach reduces errors through automated calculations, centralizes data management, and eliminates redundant entry. You’ll see measurable results with up to 35% lower turnover and 28% cost savings, plus increased employee satisfaction through easier benefits access. Understanding the full scope of payroll-integrated benefits reveals even more strategic advantages for your business growth.

Streamlined Administrative Processes and Cost Savings

A well-designed payroll-integrated benefits system considerably reduces administrative overhead and operational costs. I’ve found that centralizing benefits administration through payroll eliminates redundant data entry, minimizes errors, and automates complex calculations. You’ll save on staffing costs while ensuring accurate deductions and contributions.

Enhanced Tax Benefits and Compliance Management

Managing employee benefits through payroll offers significant tax advantages while safeguarding regulatory compliance. I’ll show you how integrating benefits with payroll systems maximizes your tax efficiency and protects your business from compliance risks.

- Pre-tax deductions lower your company’s payroll tax liability and reduce employees’ taxable income, creating win-win savings

- Automated tax calculations and reporting guarantee accurate IRS compliance, minimizing audit risks and penalties

- Built-in compliance monitoring keeps you current with changing regulations, including ACA requirements and state-specific laws

You’ll gain control over your tax position while maintaining pristine compliance records—essential elements for strategic business growth.

Increased Employee Satisfaction and Retention

Professional payroll-integrated benefits substantially boost workforce satisfaction and long-term retention. I’ve witnessed how streamlined benefits administration through payroll creates a more engaged workforce by giving employees convenient access to their chosen benefits.

| Satisfaction Driver | Impact on Retention | Measurable Outcome |

|---|---|---|

| Easy Benefits Access | Higher Engagement | 35% Lower Turnover |

| Clear Value Display | Increased Loyalty | 28% Cost Savings |

| Self-Service Tools | Better Work-Life | 42% Higher Ratings |

When I implement integrated benefits, I consistently see improved employee survey scores and decreased turnover rates. Your teams will appreciate the transparency and control they gain over their compensation packages.

Improved Accuracy and Error Reduction

Beyond boosting employee satisfaction, integrated payroll benefits significantly reduce human error in benefits administration. I’ve found that automation streamlines complex calculations and eliminates manual data entry pitfalls that often plague traditional benefits management.

Your organization can achieve superior accuracy through:

- Real-time validation checks that flag discrepancies before they become costly mistakes

- Automated tax calculations that guarantee precise withholding and compliance with regulations

- Synchronized data flows between payroll and benefits systems that eliminate duplicate entries

Real-Time Tracking and Reporting Capabilities

Robust real-time tracking and reporting capabilities serve as the backbone of modern payroll benefits administration. I’ve found that accessing up-to-the-minute data empowers you to make strategic decisions about your benefits offerings while maintaining strict compliance standards. You’ll have instant visibility into enrollment rates, participation levels, and cost analyses across all benefit categories.

I recommend leveraging these capabilities to generate thorough reports for stakeholders, track benefit utilization trends, and identify cost-saving opportunities. You can monitor key performance indicators, safeguard regulatory compliance, and adjust your benefits strategy based on real-time data insights, giving you a competitive edge in talent retention.