To effectively manage petty cash through bookkeeping, I recommend establishing a clear policy with defined fund limits and authorized usage guidelines. You’ll need a robust tracking system using digital spreadsheets or accounting software, coupled with meticulous documentation of all transactions and receipts. Implement regular reconciliation practices, including daily cash counts and weekly receipt matching. Secure your funds through strict access controls and a dual-control disbursement system. These fundamental practices will set the foundation for your exhaustive petty cash management strategy.

Establishing a Clear Petty Cash Policy and Procedures

A well-defined petty cash policy serves as the foundation for effective cash management in any organization. I recommend implementing strict guidelines that specify maximum fund amounts, authorized usage, and replenishment procedures. You’ll need to designate a custodian who maintains the fund and enforces compliance.

I’ll emphasize that your policy must outline documentation requirements, including receipts, vouchers, and reconciliation forms. Set clear spending limits for individual transactions and establish approval hierarchies. You should define prohibited expenses and mandate regular audits. By creating these structured controls, you’ll minimize risk and maintain precise oversight of your petty cash operations.

Setting Up an Effective Tracking System

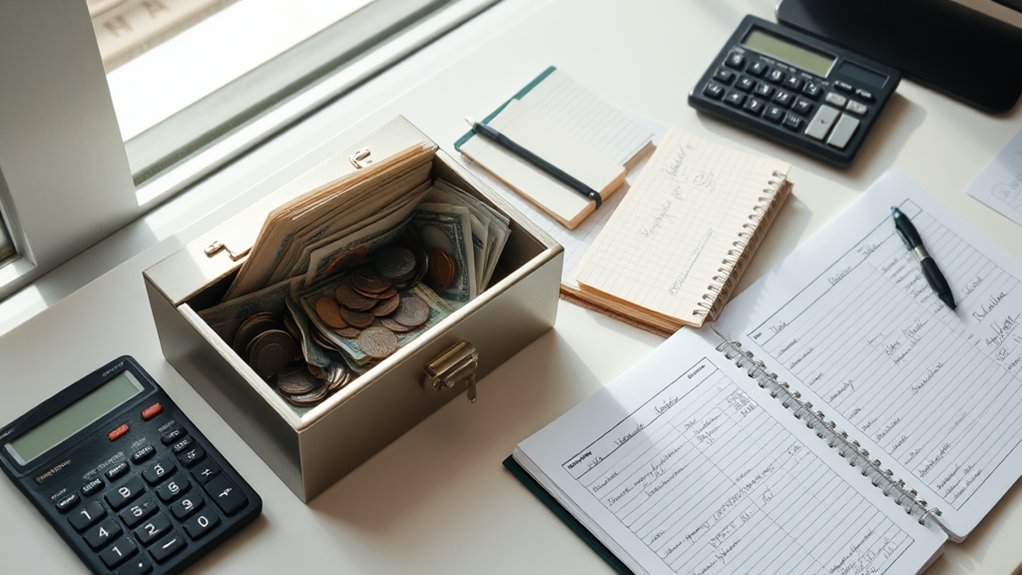

Building on your established policy framework, proper tracking mechanisms guarantee every petty cash transaction remains documented and verifiable. I recommend implementing a digital spreadsheet or specialized accounting software to record each disbursement and replenishment. You’ll want to include essential fields: date, amount, recipient, purpose, receipt number, and running balance.

I’ve found that maintaining a sequential voucher system strengthens your control. Assign unique numbers to each transaction, cross-reference these with physical receipts, and store everything in a dedicated file. This system lets you conduct swift reconciliations and detect discrepancies immediately, giving you complete command over your petty cash operations.

Maintaining Proper Documentation and Receipts

While tracking petty cash transactions forms the foundation, meticulous documentation serves as your financial shield against errors and fraud. I recommend storing all receipts in a dedicated folder, organizing them chronologically, and scanning copies for digital backup. You’ll need to enforce a strict policy requiring detailed receipts that show the date, amount, purpose, and who made the purchase.

When employees submit receipts, I insist they sign and date them immediately. For missing receipts, implement a standardized form that captures essential transaction details and requires supervisor approval. This documentation protocol strengthens your audit trail and reinforces financial accountability.

Implementing Regular Reconciliation Practices

Regular reconciliation of petty cash guarantees accuracy and detects discrepancies early in the accounting cycle. I recommend implementing a structured reconciliation process to maintain control over your funds.

| Action | Frequency |

|---|---|

| Count cash | Daily |

| Match receipts | Weekly |

| Update ledger | Weekly |

| Review variances | Monthly |

| Audit records | Quarterly |

I’ll help you establish these practices to protect your financial interests. By tracking every transaction meticulously, you’ll maintain dominance over your cash flow. When you reconcile regularly, you’ll catch errors, prevent fraud, and demonstrate your commitment to financial excellence. Remember, precise reconciliation practices reflect strong leadership and control.

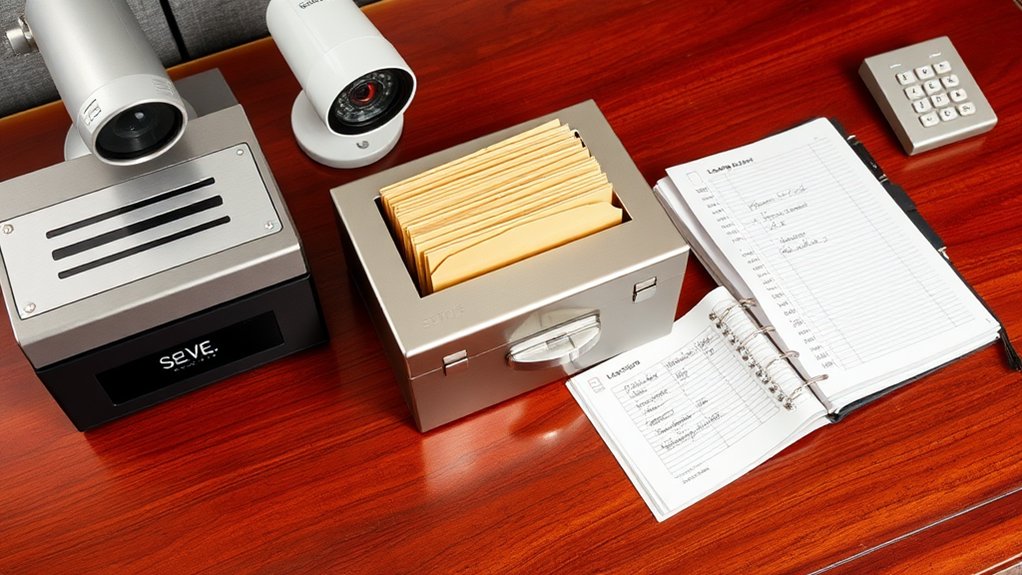

Security Measures and Access Control Guidelines

To safeguard your petty cash fund effectively, implementing robust security measures and strict access controls is essential. I recommend installing a high-quality safe in a secure location and limiting access to only authorized personnel who’ve been thoroughly vetted. You’ll need to establish clear protocols for key custody and maintain a detailed access log.

I advise instituting a dual-control system where two authorized employees must be present during fund disbursement. You should also implement surveillance cameras and regular spot checks. Require immediate reporting of any security breaches and establish consequences for policy violations to maintain iron-clad control over your petty cash.