To handle bookkeeping for your seasonal business, I recommend tracking at least three years of financial data to identify distinct revenue patterns and cash flow cycles. You’ll need to establish separate budgets for peak and off-peak periods, allocating 20-30% of high-season revenue for slower months. Use specialized software like QuickBooks Enterprise or Xero for inventory and staff management, while implementing robust tax planning strategies. Understanding these fundamental elements will unveil the keys to effective seasonal financial management.

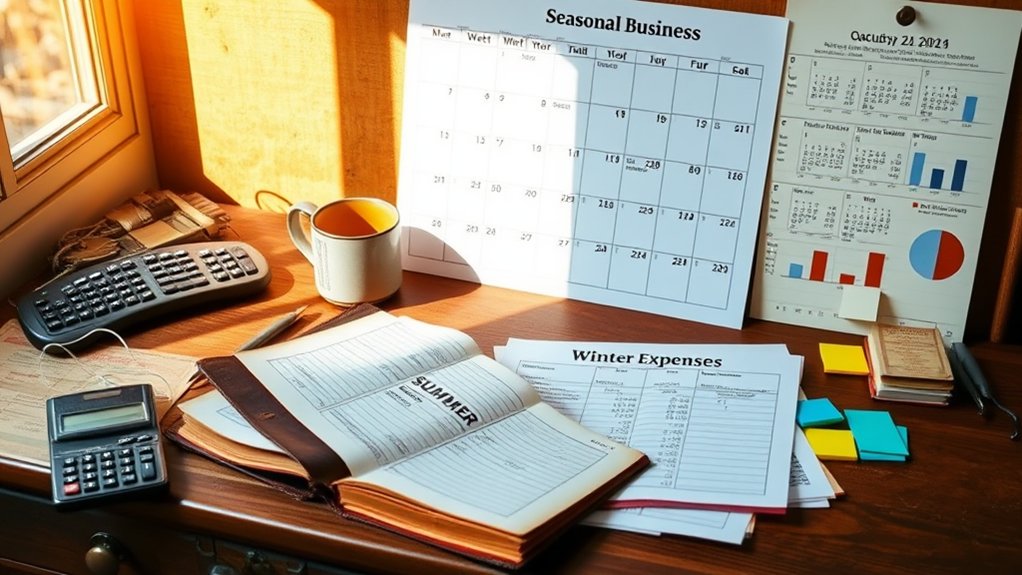

Understanding the Unique Financial Cycles of Seasonal Operations

Three distinct patterns characterize seasonal businesses’ financial cycles: peak seasons with revenue surges, off-peak periods with minimal income, and shifts requiring careful cash management.

I’ve found that success depends on understanding your specific revenue pattern. Whether you’re running a summer beach resort, holiday retail shop, or tax preparation service, I’ll help you map your cash flow timeline. You’ll need to identify your peak earning windows, anticipate slow periods, and calculate your year-round operational costs.

I recommend tracking at least three years of financial data to establish reliable patterns and predict future cycles. This knowledge becomes your strategic advantage for budgeting and growth planning.

Budgeting Strategies for Peak and Off-Peak Periods

While consistent revenue might be ideal, seasonal businesses must implement distinct budgeting approaches for their peak and off-peak periods. I recommend creating two separate budgets: one for your high-revenue months and another for slower periods. During peak season, I suggest allocating 20-30% of your revenue for off-peak operating expenses. You’ll want to establish strict spending controls during slower months, focusing only on essential maintenance and minimal staffing costs. I’ve found that maintaining a dedicated reserve fund, typically 3-6 months of operating expenses, safeguards against unexpected downturns and secures year-round stability.

Managing Cash Flow During Low-Revenue Months

The challenge of maintaining healthy cash flow during off-season months requires strategic financial planning and disciplined execution. I’ll show you how to build financial resilience through proven cash management techniques.

| Strategy | Action | Impact |

|---|---|---|

| Reserve Building | Set aside 20-30% peak revenue | Safety net creation |

| Cost Reduction | Implement seasonal staffing | Lower fixed expenses |

| Revenue Streams | Develop off-season products | Income diversification |

| Credit Lines | Secure financing pre-season | Emergency capital access |

I recommend implementing automatic savings transfers during peak months and negotiating extended payment terms with suppliers. You’ll also want to invest in financial forecasting tools to predict and prepare for cash flow gaps before they occur.

Essential Bookkeeping Software and Tools for Seasonal Businesses

Selecting appropriate bookkeeping software for seasonal businesses demands careful consideration of industry-specific features and scalability options. I recommend QuickBooks Enterprise for its robust inventory tracking and flexible user licenses, which you can adjust during peak seasons. For smaller operations, Xero offers excellent seasonal staff management and project costing features.

I’ve found that integrating time-tracking tools like TSheets or automated payroll systems like Gusto maximizes efficiency. You’ll also need cloud storage solutions for document retention. Consider implementing forecasting tools like Float or Spotlight Reporting to better predict and manage your seasonal fluctuations. These tools will strengthen your financial control year-round.

Tax Planning and Compliance for Variable Income Streams

Beyond software implementation, managing taxes for seasonal income requires a strategic approach to prevent cash flow issues and minimize tax liability. I recommend setting aside 25-30% of your peak season revenue for quarterly estimated tax payments. Track your expenses meticulously during off-seasons to maximize deductions.

I’ve found that establishing an LLC or S-corporation can provide tax advantages for seasonal operations. Consider accelerating expenses into high-income periods and deferring income into slower months when possible. Work with a tax professional to implement income averaging strategies and identify industry-specific deductions. Maintain separate business accounts to clearly document your revenue fluctuations.

Financial Reporting Best Practices for Seasonal Enterprises

I’ll teach you three critical financial reporting practices that successful seasonal businesses must master. You’ll need to monitor your monthly cash flow meticulously while creating year-round budgets that account for both peak and off-peak periods. I recommend implementing a resource management system that tracks your operational costs during slow seasons, ensuring you maintain accurate financial records even when business activity is minimal.

Track Monthly Cash Flow

Maintaining tight control over cash flow presents unique challenges for seasonal businesses, where income often arrives in concentrated bursts throughout the year. I recommend implementing a robust monthly cash flow tracking system that captures every dollar flowing in and out of your operation. Track fixed costs, variable expenses, and revenue patterns to build an accurate financial model.

I’ve found that successful seasonal businesses maintain detailed monthly projections, comparing actual results against forecasts. This empowers you to make strategic decisions about expense timing, inventory purchases, and staffing levels. Your cash flow tracking system becomes your tactical advantage for maintaining year-round financial stability.

Year-Round Budget Planning

Effective budget planning for seasonal businesses requires three core components: high-season revenue forecasting, off-season expense management, and strategic cash reserves allocation.

I recommend you map out your peak season revenue targets first, factoring in historical data and market trends. You’ll need to calculate your profit margins carefully, ensuring they’ll cover your off-season expenses.

During slower months, I advise implementing strict cost controls. Build a reserve fund of at least 20% of your annual revenue to manage cash flow gaps. You’ll want to maintain detailed monthly projections, adjusting them based on real-time performance data to optimize your financial position year-round.

Off-Season Resource Management

Three critical financial reporting practices should guide your off-season resource management. During slow periods, I recommend maintaining strict cash flow monitoring, reducing operational costs, and establishing reserve funds. These strategies guarantee your business remains financially stable year-round.

- Track every expense meticulously using automated accounting software

- Implement a lean staffing model with cross-trained employees

- Negotiate favorable payment terms with vendors during peak season

- Create emergency funds equal to 6 months of operating expenses

- Invest in preventive maintenance to avoid costly repairs

Master these practices to transform your off-season from a financial burden into a strategic advantage. Your disciplined approach will position you for sustained growth and market dominance.