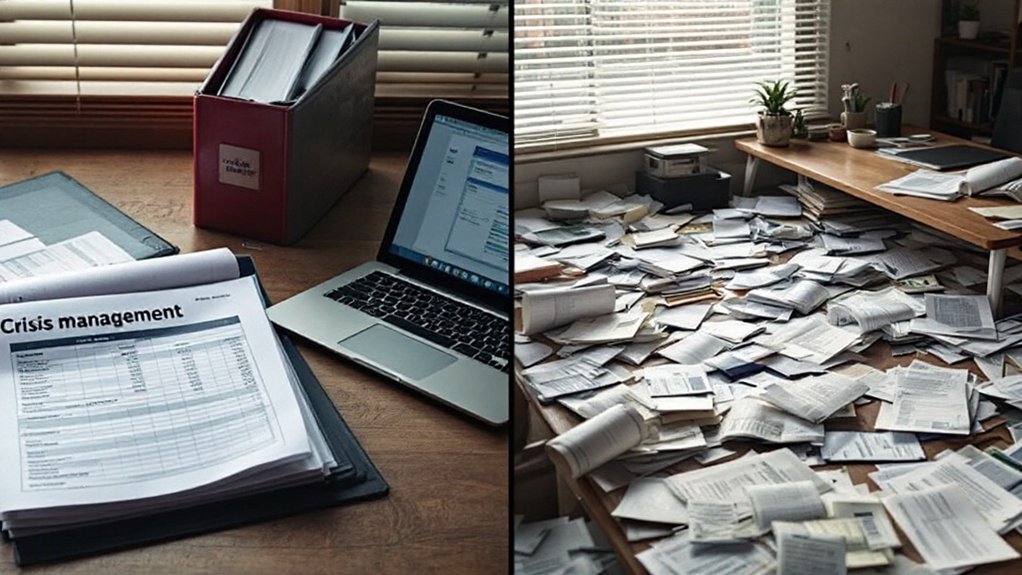

A well-implemented bookkeeping system provides you with pivotal early warning signals through systematic financial data analysis, enabling proactive crisis management. You’ll gain real-time insights into cash flow patterns, profit margins, and expense ratios, allowing for swift decision-making during market turbulence. This financial visibility strengthens your position with stakeholders, creditors, and lenders while building long-term resilience. The following key strategies will transform how you protect your business during uncertain times.

Early Risk Detection Through Financial Data Analysis

Through systematic analysis of financial data, bookkeeping enables small business owners to identify potential risks before they become critical problems. I’ll show you how to leverage your financial records to detect early warning signs. By tracking cash flow patterns, profit margins, and expense ratios, you’ll spot negative trends immediately. You can monitor accounts receivable aging to prevent liquidity issues and analyze inventory turnover rates to optimize stock levels. When you implement variance analysis, you’ll identify deviations from projected performance metrics. I recommend establishing threshold alerts for key financial indicators, giving you decisive control over your business’s financial health and strategic positioning.

Enhanced Cash Flow Management During Crisis Periods

A robust bookkeeping system proves invaluable during economic downturns and crisis periods. I’ve found that precise cash flow tracking enables you to maintain control when market conditions deteriorate. By monitoring daily inflows and outflows, you’ll identify critical spending patterns and cash reserves needed for survival.

I recommend leveraging your bookkeeping data to create crisis-specific forecasting models. This empowers you to execute rapid financial pivots, negotiate with creditors from a position of strength, and capitalize on emerging opportunities while competitors struggle. You’ll also maintain the documentation required to secure emergency funding or government assistance when timing is critical.

Real-Time Decision Making With Accurate Financial Insights

Reliable bookkeeping data enables strategic decision-making by providing real-time visibility into your business’s financial position. I’ll show you how to leverage this data to make informed choices that maximize your market advantage.

Through accurate financial insights, you’ll identify emerging trends, seize opportunities, and mitigate risks before they impact your bottom line. I recommend focusing on key performance indicators that align with your strategic objectives. You’ll track profit margins, cash reserves, and operational efficiency metrics to optimize resource allocation.

Streamlined Communication With Stakeholders and Creditors

Professional bookkeeping streamlines essential communications between your business and its key stakeholders. I’ve found that maintaining organized financial records enables you to quickly provide investors, lenders, and partners with accurate data they need for decision-making. You’ll strengthen creditor relationships by demonstrating fiscal responsibility through precise documentation of cash flows, debt servicing, and payment histories.

When stakeholders request financial updates, I recommend leveraging your bookkeeping system to generate standardized reports instantly. This capability positions you to control negotiations and secure better terms while reducing the friction typically associated with information sharing. You’ll command greater authority in stakeholder discussions through data-driven insights.

Building Financial Resilience for Long-Term Sustainability

Through systematic bookkeeping practices, your business can develop the financial resilience needed to weather economic uncertainties and market fluctuations. I’ll show you how proper financial records enable you to build strategic cash reserves, identify cost-saving opportunities, and maintain ideal working capital ratios.