To analyze crisis management costs through bookkeeping, I’ll help you establish dedicated cost centers and real-time tracking systems specifically for emergency expenses. You’ll need to implement standardized documentation protocols, configure your accounting software for crisis-specific transactions, and set up automated monitoring alerts. I recommend creating detailed expense logs with cost codes, timestamps, and authorization signatures while maintaining variance analyses against budgeted amounts. The following framework will transform your crisis financial management into a data-driven system.

Setting Up Crisis-Specific Cost Categories and Tracking Systems

Every crisis management operation requires a structured approach to cost tracking from day one. I recommend establishing distinct cost centers aligned with your crisis response framework. Set up dedicated general ledger accounts for emergency staffing, equipment deployment, external consultants, and communications.

I’ll maximize your tracking efficiency by implementing real-time data capture systems. Create crisis-specific cost codes for each response category, enabling granular analysis of expenditure patterns. Configure your accounting software to verify crisis-related transactions automatically, and establish validation protocols to authenticate accurate cost allocation. This framework will drive precise financial oversight during critical operations.

Documenting Emergency Expenses and Resource Allocation

Clear expense documentation forms the backbone of effective crisis cost management. I recommend implementing a standardized system for capturing all emergency-related costs, including personnel overtime, equipment deployment, and third-party services. I track these expenses using digital forms that require specific cost codes, timestamps, and authorization signatures.

To optimize resource allocation, I maintain real-time logs of asset utilization and map them against predefined emergency response protocols. This enables me to identify cost patterns, adjust resource deployment strategies, and generate detailed audit trails. I can then leverage this data to justify expenditures and secure reimbursements from insurance or government agencies.

Implementing Real-Time Financial Monitoring Protocols

I’ll walk you through implementing real-time financial monitoring protocols that integrate daily cash flow tracking with predefined alert thresholds. Through my experience, I’ve found that establishing automated alerts when expenditures reach critical levels helps prevent cost overruns during crisis situations. The systematic monitoring of cost variance reports enables me to identify spending anomalies and adjust resource allocation immediately, maintaining financial control during emergency operations.

Track Daily Cash Flow

During crisis management, implementing a robust daily cash flow tracking system serves as your financial early warning system. I recommend monitoring three critical components that give you immediate visibility into your cash position:

- Track real-time inflows and outflows through automated bank feed integrations to spot concerning patterns before they become problems

- Monitor accounts receivable aging daily to identify collection risks and take swift action

- Analyze cash conversion cycles to optimize working capital and maintain emergency reserves

This granular tracking empowers you to make data-driven decisions about resource allocation and helps anticipate potential liquidity constraints before they impact operations. I insist on reviewing these metrics each morning to maintain strict financial control.

Establish Alert Thresholds

Building upon our daily cash flow tracking system, setting precise alert thresholds creates an automated defense mechanism against financial risks. I’ll show you how to establish critical boundaries that trigger immediate action when breached.

I set primary thresholds at 15% below projected cash reserves and secondary alerts at 25% deviation from expected expense ratios. These multi-tiered triggers enable me to intercept potential crises before they escalate. I integrate these thresholds into my accounting software, programming automated notifications for key metrics including working capital, burn rate, and debt-service coverage ratios. This systematic approach empowers rapid response to emerging financial threats.

Monitor Cost Variance Reports

Three essential components drive effective cost variance monitoring: real-time data feeds, automated comparison algorithms, and exception-based reporting protocols. I’ve implemented these systems to detect cost anomalies instantly across crisis management operations.

- My dashboard receives live financial data streams from ERP systems, tracking expenditures against predefined crisis budgets

- I leverage AI-powered variance analysis that flags deviations exceeding statistical norms

- My exception reports trigger immediate alerts when costs breach established thresholds

I maintain strict control through continuous monitoring of key metrics, enabling rapid response to financial irregularities. This systematic approach guarantees I can intervene before minor variances become major financial concerns.

Analyzing Cost Patterns and Financial Impact Assessment

When analyzing crisis management costs, organizations must systematically evaluate spending patterns and quantify the financial ripple effects across operations. I recommend tracking cost variations against historical baselines to identify anomalies and emerging trends. By correlating expense spikes with specific crisis events, I can pinpoint which incidents drive the highest financial impact.

I assess both direct expenditures and hidden costs, including productivity losses, resource reallocation, and opportunity costs. Using regression analysis and predictive modeling, I forecast future cost implications and recommend strategic adjustments to optimize crisis-related spending while maintaining operational resilience.

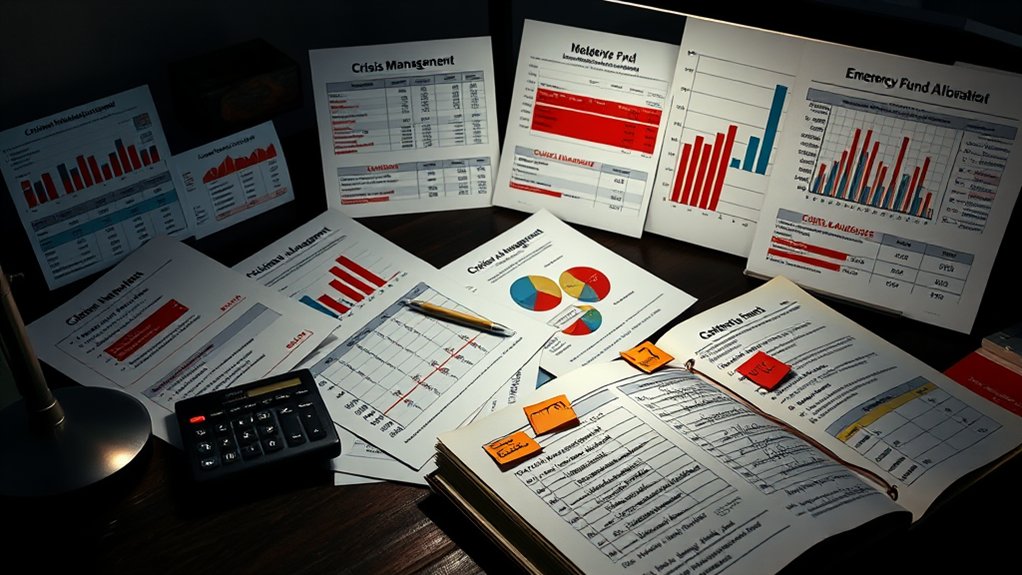

Creating Crisis Budget Reports and Variance Analysis

Since effective crisis management relies on accurate financial tracking, detailed budget reports must detail both planned and actual expenditures while highlighting key variances. I recommend implementing robust variance analysis to identify cost deviations and their root causes.

- Deploy real-time expense tracking systems to capture crisis-related costs against budgeted amounts

- Analyze variances by cost category, including personnel, equipment, and external services

- Calculate key performance indicators (KPIs) to measure financial impact and response effectiveness

I guarantee my variance reports include statistical trends, threshold breaches, and corrective action recommendations. This data-driven approach empowers quick decisions and helps maintain financial control during crisis events.

Developing Data-Driven Recovery and Prevention Strategies

I analyze historical crisis cost patterns to establish baseline metrics and identify recurring expenditure trends that inform future prevention strategies. I’ll help you build data-driven cost models that quantify potential prevention investments against projected crisis impacts, incorporating variables like frequency, severity, and mitigation effectiveness. By measuring the financial impact of past crises against prevention investments, you’ll be able to optimize resource allocation and demonstrate ROI for proactive crisis management initiatives.

Track Historical Cost Patterns

Tracking historical cost patterns enables organizations to make data-driven decisions for both crisis recovery and prevention strategies. I analyze past financial data to identify trends and correlations that reveal critical insights for optimizing crisis management expenses.

Key patterns I monitor include:

- Incident response costs across different crisis types and severity levels

- Seasonal variations in emergency expenditures and resource allocation

- Cost-benefit ratios of various prevention measures and their long-term ROI

Build Prevention Cost Models

Building effective prevention cost models requires systematic analysis of historical data combined with predictive analytics to forecast potential crisis expenses. I recommend categorizing prevention investments across three key dimensions to optimize resource allocation:

| Prevention Area | Cost Components | ROI Metrics |

|---|---|---|

| Infrastructure | Systems/Tools | Risk Reduced |

| Training | Staff Time | Skills Gained |

| Monitoring | Tech Resources | Issues Caught |

I’ve found that quantifying prevention costs against potential crisis impacts helps justify budgets. By tracking these metrics systematically, I can demonstrate the value of proactive investments versus reactive spending, strengthening my case for adequate prevention funding.

Measure Impact Vs Investment

To effectively evaluate crisis management programs, measuring the relationship between financial impact and investment requires robust data analysis and clear ROI metrics. I analyze three key data points to assess performance:

- Cost avoidance achieved through preventive measures vs. actual crisis response expenses

- Revenue protection percentages compared to program implementation costs

- Long-term value creation from enhanced resilience vs. initial capital outlay

I leverage advanced analytics to calculate these metrics, enabling precise investment decisions. By quantifying both direct and indirect benefits against total program costs, I can determine ideal resource allocation and justify strategic crisis management investments to stakeholders.